Bonnie and Clyde, Ma Barker, Baby Face Nelson and Willie Sutton robbed banks. When asked by a journalist asked why he did, Sutton famously replied “because that’s where the money is.” If banks’ $3.1 trillion in cash and invested assets draws criminals to steal from banks, the insurance industry’s $10 trillion in assets arguably tempts fraudsters yet more. And it does.

Whereas banks’ annual losses from fraud are on the order of $2.7 billion, insurance fraud measures a staggering $308.6 billion annually. The FBI, which prosecutes significant insurance fraud cases, affirms the insurance industry’s massive size “contributes significantly to the cost of insurance fraud by providing more opportunities and bigger incentives for committing illegal activities.” And from the fraudster’s point of view, insurance fraud is a crime not requiring a gun, a mask or a getaway car. In an era of congressional hearings on how to reduce the cost of insurance for consumers, one solution is to attack insurance fraud. Insurers’ fraud-related losses are passed onto all policyholders. If insurance fraud were wiped out premiums would be 10 percent lower.

Insurance fraud is the second-largest category of white-collar crime, following tax evasion. Insurers’ massive hemorrhaging from fraud makes theft in other industries pale by comparison. Retailer shrink (theft) rate is 1.6 percent. Wholesaler/inventory shrink rate is estimated at 4 percent.

Insurance fraudsters may justify cheating an insurance company because it is thought to be a victimless crime. In a recent survey of attitudes surrounding insurance fraud, almost 9 percent of respondents justified insurance fraud as not being wrong or criminal based on their belief that “insurance companies rip people off, so it’s fair” and “I pay them enough, it’s my money I’m getting back.” The survey revealed a high percentage of respondents (28.6% percent) finding insurance fraud “not a real crime” (8.5 percent) or constituted a “business practice with no real victim” (20.1 percent).

The Many Flavors of Insurance Fraud

Insurance fraud comes in many forms and sizes. It ranges from registering automobiles in a state other than the state of ones residence because fees and insurance there can “save” hundreds of dollars, to a recently uncovered scheme which scammed Medicare $2 billion.

Some of the main types of insurance fraud, in decreasing order of fraud amount, are:

| Insurance Fraud Category | Description or Example | Estimated Annual Fraud Amount |

| Life Insurance | Failure to report medical condition, buying a life insurance policy on someone else’s life and murdering them, faking death | $74.7 billion |

| Medicaid and Medicare | Providing unnecessary services | $68.7 billion |

| Property & Casualty | Staged accidents, arson | $45.0 billion |

| Healthcare | Providers billing for services not rendered | $36.3 billion |

| Premium Avoidance | Misclassification of employees or underreporting payroll | $35.1 billion |

| Workers’ Compensation | Worker claiming to have been injured on the job, but was not | $34.0 billion |

| Disability | Claiming to be on disability with no mobility while training for a 10k footrace not for the wheelchair-bound | $7.4 billion |

| Auto Theft | Perpetrated solo or operated as a profit center by criminal gangs | $7.4 billion |

| Total | $308.6 billion |

(Data source: The Impact of Insurance Fraud on the U.S. Economy. Coalition Against Insurance Fraud. 2022. https://insurancefraud.org/wp-content/uploads/The-Impact-of-Insurance-Fraud-on-the-U.S.-Economy-Report-2022-8.26.2022.pdf)

Troubling Generational Trends

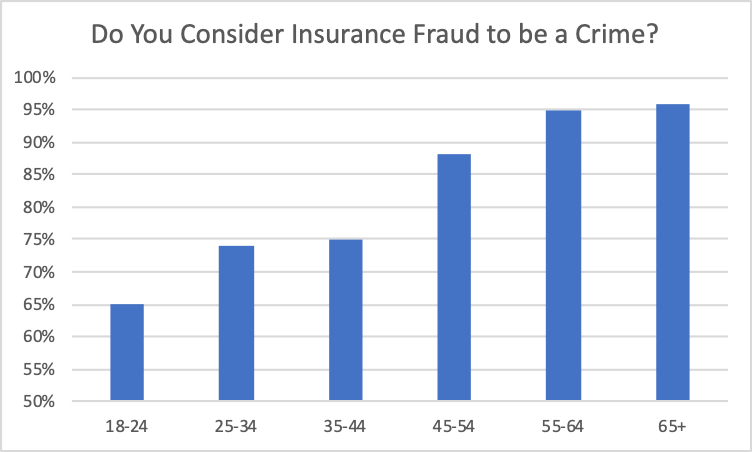

Whether someone considers insurance fraud a crime or not depends to some degree on their age. In the report presenting findings of the “Who Me?” study, respondents 45 and older were much more prone to consider insurance fraud a crime. For the youngest respondents, aged 18 to 24, just under 65 percent did, whereas 96 percent of respondents 65 and older did.

(Data Source: Who Me? Who Commits Insurance Fraud and Why? Coalition Against Insurance Fraud and Verisk. 2023. Used with permission. https://insurancefraud.org/wp-content/uploads/WHO_ME_STUDY_REPORT.pdf)

The “Who Me?” survey also found respondents under the age of 45 reporting a significantly higher level of dishonesty than those a generation older. The under-45 respondents were found to be much more prone to “Definitely … Submit a Claim for a Vehicle Caused in a Prior Car Accident,” to submit a claim for a homeowners or insurance policy with damage from an earlier event, and would “definitely would help a medical provider bill an insurance company for treatment I didn’t receive.”

As the older generation ages out, insurance companies should be concerned they will increasingly be dealing with respondents self-reporting as having fewer scruples about committing insurance fraud

Tales from the Dark Side

Some of the most chilling examples of insurance fraud are grisly affairs revealing the darkest of humanity’s dark side:

- John Gilbert Graham placed a time-release bomb on a plane in which his mother was traveling, for the life insurance payment. The bomb exploded. In addition to Graham’s mother all 43 other passengers and crew perished.

- Utah physician Farid Fata administered chemotherapy to hundreds of women who did not have cancer. Fata submitted $34 million in fraudulent claims to Medicare and private insurance companies.

- Ali Elmezayen staged a freak car accident which took the lives of his two autistic children and nearly drowned his wife. He collected a $260,000 insurance payout, but his crime was discovered. He was sentenced to 212 years in prison.

- A Chicago federal grand jury charged 23 defendants with participating in a fraud scheme swindling $26 million from ten life insurers. The scheme featured submission of fraudulent applications to obtain policies, and misrepresenting the identity of the deceased.

There are thousands of other equally horrific insurance fraud stories. The annual Dirty Dozen Hall of Shame report describes some of the most egregious, and contributes to an understanding of how far fraudsters will go to cheat insurance companies.

How is Insurance Fraud Addressed?

There are multiple organizations combatting insurance fraud. In 42 states the insurance department has a fraud investigation unit. In other states, such as Colorado, insurance fraud investigations are the responsibility of the Attorney General’s office. The fraud units are staffed with anti-fraud and criminal investigators working with federal, state, and local law enforcement officials to prosecute insurance fraud. When multiple states are involved in the fraud or if it is a large case, the FBI may pursue the case on a criminal basis. Insurance companies also have internal Special Investigation Units (SIUs).

New Developments – Artificial Intelligence

Improvements in predictive modeling and the introduction of artificial intelligence (AI) have strengthened insurers abilities to identify, and ultimately investigate, submitted claims that may be fraudulent. At the same time, however, AI is also being used as a weapon to penetrate insurers’ fraud detection systems. Techniques being used include AI-created fake photographs of cars of a particular make and model showing damage that is not real, but used to extract a claims payment. Some insurers are no longer accepting photos because they may be doctored, and are returning to adjustors physically visiting the allegedly damaged car. A nefarious life insurance scam includes AI-enabled manipulation of ones voice so that a criminal third party gets past insurers’ voice recognition technology, and initiates a policy being surrendered to a non-policyholder, non-beneficiary. It seems that for every additional layer of protection insurers introduce, the criminals are keeping up, if not forging ahead.

Action Required

Insurers need to strengthen their inoculation against the insurance fraud germ. They should educate younger generations to know that insurance fraud is indeed a crime, regardless if they think otherwise. In today’s populist political environment big business, including insurers, is too often singled out as responsible for whatever ills there may be. As we have argued elsewhere, the combined effect of plaintiff attorney firms vilifying insurers, and zealous consumer advocates denouncing insurers, is to give the industry a black eye. What is more, younger generations’ image of the insurance industry is colored by billboard attorneys promising to stick it to the insurance company.

Insurers should also join forces with other parties battling insurance fraud – state insurance department fraud units, local and federal law enforcement, and organizations such as the Coalition Against Insurance Fraud and the National Insurance Crime Bureau. As insurance fraudsters exploit new technologies, and as the younger generations with negative views on insurance become policyholders, the fight may get tougher, but it must be fought if combatting insurance crime can ever be a driver of lower insurance rates.