When it comes to planning for your financial future, choosing the right investment vehicle is crucial. Two popular options often debated are Roth IRA vs whole life insurance policies.

Both of these plans offer unique benefits and considerations, making it essential to understand their differences and how they align with your financial goals. In this blog post, we’ll explore the features, pros, and cons of Roth IRA vs whole life insurance to help you make an informed decision.

Let’s explore together!

What is a Roth IRA?

A Roth IRA, short for Individual Retirement Account, is a type of retirement savings account that offers unique tax advantages. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get an immediate tax deduction for your contributions.

However, the major benefit kicks in during retirement: qualified withdrawals from a Roth IRA are entirely tax-free. This includes both the contributions you initially made and any investment gains you’ve accrued over the years. Essentially, Roth IRAs allow your money to grow tax-free, providing a valuable source of income in retirement without worrying about hefty tax bills.

In addition, Roth IRAs offer flexibility in terms of withdrawals, as there are no required minimum distributions (RMDs) during your lifetime, unlike traditional IRAs, where you’re mandated to start withdrawing a certain amount at a certain age. Overall, Roth IRAs are a popular choice for individuals looking to diversify their retirement savings and potentially minimize their tax burden in the long run.

Benefits and Drawbacks of Roth IRAs

Pros of Roth IRAs

Tax-Free Withdrawals: Qualified withdrawals from a Roth IRA are tax-free, providing tax diversification in retirement.

No Required Minimum Distributions (RMDs): Roth IRAs do not mandate RMDs during the account holder’s lifetime, allowing for flexible withdrawals.

Access to Contributions: You can withdraw your Roth IRA contributions penalty-free at any time, providing a source of emergency funds.

Investment Flexibility: Roth IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, allowing you to tailor your portfolio to your risk tolerance and financial goals.

Cons of Roth IRAs

Contribution Limits: Roth IRA contributions are subject to annual limits set by the IRS, potentially restricting higher-income earners.

Income Eligibility: Individuals with high incomes may not be eligible to contribute directly to a Roth IRA, although strategies such as the backdoor Roth IRA may provide alternatives.

No Tax Deductions: Unlike traditional IRAs, contributions to a Roth IRA are not tax-deductible, which may deter some investors seeking immediate tax benefits.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. Unlike term life insurance, which covers a specific period (e.g., 10, 20, or 30 years), whole life insurance offers lifelong protection.

One of the key features of whole life insurance is its cash value component. A portion of the premium payments goes towards building cash value within the policy, which grows over time on a tax-deferred basis. This cash value can be accessed by the policyholder through withdrawals or policy loans during their lifetime.

Moreover, whole life insurance policies provide a guaranteed death benefit to beneficiaries upon the insured individual’s passing, offering financial security and peace of mind to loved ones. While whole life insurance typically has higher premiums compared to term life insurance, it offers permanent coverage and a cash accumulation feature, making it an attractive option for those seeking both insurance protection and a long-term investment component.

Benefits and Drawbacks of Whole Life Insurance

Pros of Whole Life Insurance

- Guaranteed Death Benefit: Whole life insurance guarantees a death benefit payout to beneficiaries, providing financial security for loved ones.

- Cash Value Growth: Whole-life policies accumulate cash value over time, which grows tax-deferred and can be accessed during the policyholder’s lifetime.

- Tax Advantages: Withdrawals and loans from the cash value of a whole-life policy are generally tax-free up to the amount of premiums paid, providing tax-efficient income in retirement.

- Lifetime Coverage: Unlike term life insurance, which expires after a specific term, whole life insurance provides life coverage, ensuring protection for as long as premiums are paid.

Cons of Whole Life Insurance

- Higher Premiums: Whole life insurance typically has higher premiums compared to term life insurance, making it less affordable for some individuals.

- Limited Investment Growth: The cash value growth of whole life insurance policies may be lower compared to alternative investment options, limiting potential returns.

- Complexity: Whole life insurance policies can be complex, with various fees, charges, and policy features that may be difficult for some individuals to understand.

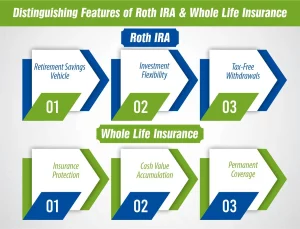

Roth IRA vs Whole Life Insurance: A Comparison

When planning for your financial future, two popular options often come into play: Roth IRA vs whole life insurance. While both offer distinct benefits, understanding their differences is crucial for making an informed decision. Here is a comparison of these two investment vehicles to help you determine which aligns best with your goals and priorities.

1- Tax Treatment

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are entirely tax-free, including investment gains.

Whole Life Insurance: Premiums are paid with after-tax dollars, and the cash value growth within the policy accumulates on a tax-deferred basis. Withdrawals or loans from the cash value are typically tax-free up to the amount of premiums paid.

2- Investment Flexibility

Roth IRA: Offers a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, providing flexibility to tailor your portfolio.

Whole Life Insurance: Limited investment options within the policy, with the cash value growth tied to the performance of the insurance company’s investment portfolio.

3- Coverage and Benefits

Roth IRA: Primarily a retirement savings vehicle, offering tax-free income in retirement and no required minimum distributions (RMDs) during the account holder’s lifetime.

Whole Life Insurance: Provides lifelong insurance coverage with a guaranteed death benefit for beneficiaries and a cash accumulation feature that can be accessed during the policyholder’s lifetime.

4- Cost Considerations

Roth IRA: Generally lower costs compared to whole life insurance, with no ongoing premiums or policy fees.

Whole Life Insurance: Typically involves higher premiums and fees, which can impact overall returns and affordability.

5- Financial Goals

Roth IRA: Ideal for individuals seeking tax-free income in retirement, flexibility in withdrawals, and long-term wealth accumulation.

Whole Life Insurance: Suitable for those looking for lifelong insurance protection, tax-deferred cash value growth, and potential legacy planning.

Which is Better – Roth IRA or Whole Life Insurance?

Determining whether a Roth IRA or whole life insurance is better depends on your unique financial situation, goals, and preferences. Here are some factors to consider when making this decision:

If your primary goal is to save for retirement and maximize tax-free income in your golden years, a Roth IRA may be the better option. Roth IRAs offer tax-free withdrawals in retirement, investment flexibility, and no required minimum distributions (RMDs), providing significant advantages for long-term wealth accumulation.

If you require lifelong insurance coverage and want to leave a legacy for your loved ones, whole life insurance could be the preferred choice. Whole life insurance offers guaranteed death benefits for beneficiaries and a cash value component that accumulates over time, providing both insurance protection and a savings component.

Consider your risk tolerance and investment preferences. Roth IRAs typically offer more investment flexibility, allowing you to customize your portfolio based on your risk tolerance and financial goals. On the other hand, whole life insurance provides a more conservative investment approach with guaranteed returns but may offer lower growth potential compared to market-based investments.

Evaluate your current and future tax situation. Roth IRAs offer tax-free withdrawals in retirement, providing valuable tax diversification and potential savings on taxes in the long run. Whole life insurance provides tax-deferred growth of cash value and tax-free access to policy loans and withdrawals, offering potential tax advantages during retirement.

Compare the costs and fees associated with each option. Roth IRAs generally have lower costs and fees compared to whole-life insurance, which may involve higher premiums and policy fees. Consider how these costs may impact your overall returns and affordability.

Ultimately, the decision between a Roth IRA and whole life insurance depends on your individual financial goals, risk tolerance, and long-term planning needs. It’s essential to carefully evaluate both options and consult with a financial advisor to determine which aligns best with your objectives and provides the most suitable solution for your financial future.

Conclusion

In the end, both Roth IRA vs whole life insurance can play valuable roles in a comprehensive financial plan, offering unique benefits and considerations. Roth IRAs provide tax-free withdrawals in retirement and investment flexibility, making them ideal for individuals seeking tax diversification and growth potential. On the other hand, whole life insurance offers a combination of insurance protection and tax-deferred cash value growth, providing lifelong coverage and potential tax advantages in retirement.