In the world of financial planning, two popular options often come up in conversations permanent life insurance and Roth IRA. Both of them offer financial security for the insured persons during difficult times.

While both serve as valuable tools for securing your financial future, they have distinct features and benefits. Understanding these differences is crucial for making informed decisions about your long-term financial strategy. And this blog post is all about making their difference clear.

In this guide, we’ll dive into the complexities of permanent life insurance vs. Roth IRA, exploring their unique features, pros, and cons. Let’s get started!

What is Permanent Life Insurance?

Permanent life insurance is a type of life insurance that provides coverage for your entire life, as long as you continue paying the premiums. Unlike term life insurance, which offers coverage for a specific period, permanent life insurance remains in effect until the insured individual dies. One of the distinguishing features of permanent life insurance is its cash value component, which accumulates over time.

Here’s how it works: a portion of your premium payments goes into a cash value account, which grows over time on a tax-deferred basis. This cash value can be accessed through policy loans or withdrawals during your lifetime, providing a source of tax-free income in retirement or for other financial needs. Additionally, permanent life insurance offers a death benefit to your beneficiaries upon your passing, which is generally tax-free.

Permanent life insurance comes in various forms, including whole life, universal life, and variable life insurance, each with its features and benefits tailored to different financial goals and risk tolerances. Overall, permanent life insurance provides lifelong coverage and a potential source of tax-deferred savings, making it a valuable tool for financial planning and estate protection.

What is a Roth IRA?

A Roth IRA, or Individual Retirement Account, is a retirement savings vehicle that offers tax-free growth and withdrawals in retirement. Unlike traditional IRAs or 401(k) plans, contributions to a Roth IRA are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute.

Here’s how it works: you contribute to a Roth IRA with money you’ve already paid taxes on. Once the money is in the account, it can grow tax-free over time. When you reach retirement age and begin withdrawing funds, those withdrawals, including any earnings, are typically tax-free as well, as long as certain conditions are met.

Roth IRAs offer several advantages, including flexibility in contributions (there’s no age limit for contributions as long as you have earned income), no required minimum distributions during the original account holder’s lifetime, and tax-free withdrawals in retirement. Additionally, Roth IRAs can be passed on to heirs tax-free, making them a valuable estate planning tool. Overall, Roth IRAs provide a tax-efficient way to save for retirement and build long-term wealth.

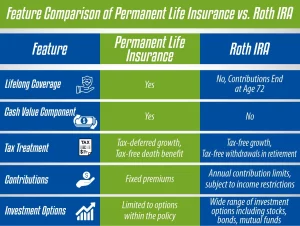

Feature Comparison of Permanent Life Insurance vs. Roth IRA

Here’s a feature comparison table for Permanent Life Insurance vs. Roth IRA:

| Feature | Permanent Life Insurance | Roth IRA |

| Lifelong Coverage | Yes | No, Contributions End at Age 72 |

| Cash Value Component | Yes | No |

| Tax Treatment | Tax-deferred growth, Tax-free death benefit | Tax-free growth, Tax-free withdrawals in retirement |

| Contributions | Fixed premiums | Annual contribution limits, subject to income restrictions |

| Withdrawal Flexibility | Partial withdrawals or loans available, subject to policy terms | Contributions can be withdrawn penalty-free, earnings may be subject to penalties if withdrawn before age 59 ½ |

| Investment Options | Limited to options within the policy | Wide range of investment options including stocks, bonds, mutual funds |

| Estate Planning Benefits | Tax-free death benefits for beneficiaries may be used as an estate planning tool | Tax-free inheritance for beneficiaries can be passed on tax-free |

| Required Minimum Distributions | Not applicable | Required starting age of 72 for distributions, except for original account holders |

Pros and Cons of Permanent Life Insurance

Here are the pros and cons of permanent life insurance:

Pros

- Lifelong Coverage: Permanent life insurance provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit whenever you pass away, regardless of age.

- Cash Value Accumulation: A portion of your premium payments goes into a cash value account, which grows over time on a tax-deferred basis. This cash value can be accessed through policy loans or withdrawals, providing a source of tax-free income during retirement or for other financial needs.

- Tax Benefits: Death benefits are generally tax-free to beneficiaries, and the cash value grows tax-deferred. This can be advantageous for estate planning and creating a tax-efficient legacy.

- Flexible Premiums: Depending on the policy type, you may have the flexibility to adjust your premium payments or even skip payments under certain conditions.

- Estate Planning: Permanent life insurance can serve as a valuable estate planning tool, providing access to cover estate taxes and ensuring that your loved ones are financially protected.

Cons

- Higher Premiums: Permanent life insurance typically has higher premiums compared to term life insurance, making it more expensive to maintain coverage.

- Complexity: Understanding the various policy features, fees, and investment options within permanent life insurance policies can be complex and may require guidance from a financial advisor.

- Surrender Charges: If you decide to surrender or cancel your permanent life insurance policy early, you may be subject to surrender charges or fees, which can reduce the cash value of the policy.

Pros and Cons of a Roth IRA

Here are the pros and cons of a Roth IRA:

Pros

- Tax-Free Growth: One of the most significant advantages of a Roth IRA is that all earnings within the account grow tax-free. This means you won’t owe taxes on investment gains, dividends, or interest earned within the account.

- Tax-Free Withdrawals in Retirement: Qualified withdrawals from a Roth IRA in retirement are tax-free. This provides you with tax-free income during your retirement years, helping to maximize your retirement savings.

- No Required Minimum Distributions (RMDs): Unlike traditional retirement accounts, Roth IRAs have no required minimum distributions during the original account holder’s lifetime. This allows you to leave your money in the account to continue growing tax-free for as long as you wish.

- Flexible Contributions: You can contribute to a Roth IRA at any age, as long as you have earned income, and there is no age limit for contributions. This flexibility allows you to continue saving for retirement even after reaching retirement age.

- Estate Planning Benefits: Roth IRAs can be passed on to heirs tax-free, providing a valuable estate planning tool for transferring wealth to the next generation. This can help you leave a tax-efficient legacy for your loved ones.

Cons

- Income Limits: Roth IRA contributions are subject to income limits. If your income exceeds the threshold set by the IRS, you may not be eligible to contribute to a Roth IRA directly.

- No Upfront Tax Deduction: Unlike traditional retirement accounts, contributions to a Roth IRA are made with after-tax dollars so that you won’t receive an upfront tax deduction for your contributions.

- Penalties for Non-Qualified Withdrawals: Withdrawals of earnings from a Roth IRA before age 59 ½ may be subject to taxes and penalties unless they meet certain exceptions such as first-time home purchase or qualified education expenses.

- Limited Contribution Limits: The annual contribution limits for Roth IRAs are relatively low compared to other retirement accounts, which may limit your ability to save for retirement in this account alone.

Choosing Between Permanent Life Insurance vs. Roth IRA

Choosing between permanent life insurance vs. Roth IRA depends on various factors, including your financial goals, risk tolerance, and long-term objectives. Here’s a guide to help you make an informed decision:

Consider Permanent Life Insurance If:

1- Lifelong Coverage is a Priority

If you want to ensure that your beneficiaries receive a death benefit regardless of when you pass away, permanent life insurance provides lifelong coverage, offering peace of mind.

2- You Seek Tax-Deferred Growth and Tax-Free Death Benefits

Permanent life insurance policies accumulate cash value over time on a tax-deferred basis, and death benefits are generally tax-free to beneficiaries. This can be advantageous for estate planning purposes and for creating a tax-efficient legacy.

3- You Want a Conservative Investment Option

Permanent life insurance offers a conservative investment option with guaranteed death benefits and a cash value component that grows steadily over time, making it suitable for those who prefer stability over higher-risk investments.

4- Estate Planning is a Priority

If passing on wealth to your heirs tax-efficiently is a priority, permanent life insurance can serve as a valuable estate planning tool, providing liquidity to cover estate taxes and ensuring financial security for your loved ones.

Consider Roth IRA If:

1- Tax-Free Growth and Withdrawals are Important

Roth IRAs offer tax-free growth on investment earnings and tax-free withdrawals in retirement, providing a significant advantage for long-term wealth accumulation and retirement income planning.

2- You Want Flexibility in Contributions and Withdrawals

Roth IRAs allow flexible contributions with no age limit, and there are no required minimum distributions during the original account holder’s lifetime. This flexibility gives you control over your retirement savings and allows you to tailor withdrawals to your financial needs in retirement.

3- You Seek Estate Planning Benefits

Roth IRAs can be passed on to heirs tax-free, providing a valuable estate planning tool for transferring wealth to the next generation. This can help you leave a tax-efficient legacy for your loved ones.

4- You’re Comfortable with Market Risk

Roth IRAs offer a wide range of investment options, including stocks, bonds, and mutual funds, allowing you to potentially achieve higher returns over the long term. If you’re comfortable with market fluctuations and willing to take on some level of risk, a Roth IRA may be a suitable option.

Conclusion

Permanent life insurance vs. Roth IRA are both valuable tools for securing your financial future and achieving long-term goals. While they serve different purposes and have distinct features, understanding the complexities of each can help you make informed decisions about your financial strategy.

Whether you prioritize lifelong coverage, tax-free growth, or estate planning benefits, there’s a solution that aligns with your needs and objectives. Consult with a financial advisor to explore your options and create a customized plan that meets your unique circumstances.