In a world where personalization is key, why should life insurance be any different? Imagine a life insurance policy customized to fit your exact needs, designed by you, for you. Enter the realm of DIY life insurance; an innovative approach reshaping the landscape of financial security.

It’s not about waiting for unforeseen events; it’s about taking control now. This isn’t just about preparing for the unknown; it’s about thriving in the present. Whether you’re a senior looking for options or seeking a way to accumulate funds while alive, DIY life insurance offers a versatile solution.

From understanding its workings to unlocking the potential of a DIY super fund, it’s time to explore this empowering avenue that puts the power of financial protection firmly in your hands. Let’s delve into the world of DIY insurance and discover how it could be your key to personalized financial security.

What Is a DIY Life Insurance Policy?

A DIY life insurance policy also known as Do-it-yourself life insurance is a personalized insurance approach that empowers individuals to create and manage their own coverage, distinct from traditional policies offered by insurance companies. Unlike conventional plans with fixed terms and limited flexibility, a DIY insurance policy allows for customization and control over various aspects of the insurance.

This unique insurance strategy typically involves combining a life insurance component with an investment or savings element. Policyholders have the flexibility to determine the coverage amount, choose investment options, and structure the policy according to their specific needs and financial goals.

The distinguishing feature of DIY insurance lies in its adaptability and the ability to cater to individual preferences. It allows policyholders to adjust premiums, allocate funds, and potentially accumulate cash value over time, offering a more personalized and dynamic approach to securing financial protection for oneself and beneficiaries.

How Does DIY Whole Life Insurance Work?

DIY whole life insurance operates as a comprehensive financial tool that combines a death benefit with a cash value accumulation component. Unlike term life insurance that covers a specific period, whole life insurance provides coverage for the insured’s entire life, as long as premiums are paid.

In a DIY whole life insurance policy, a portion of the premium payments goes towards the insurance coverage, while another portion is allocated to a cash value account. This cash value grows over time, usually on a tax-deferred basis, and can be accessed by the policyholder during their lifetime.

Cash Value Accumulation in DIY Whole Life Insurance

The cash value accumulation is facilitated by the insurance company’s investment of a portion of the premiums in various financial instruments, such as bonds or stocks. This allows the cash value to potentially grow over time, offering a source of funds that policyholders can access through policy loans or withdrawals for various financial needs, such as supplementing retirement income or covering unexpected expenses.

Additionally, DIY whole life insurance policies often provide a guaranteed death benefit, ensuring that beneficiaries receive a payout upon the insured individual’s passing, regardless of the cash value accumulated. This dual benefit of a death benefit and cash value accumulation distinguishes whole life insurance and makes it an attractive option for long-term financial planning and security.

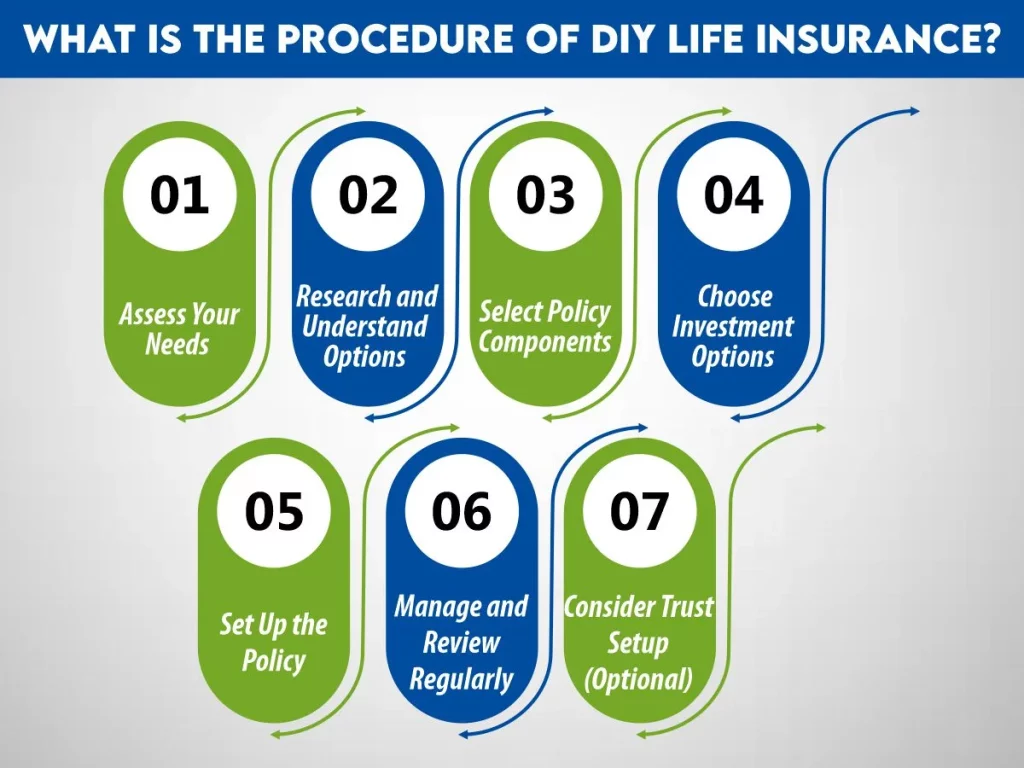

What Is the Procedure of DIY Life Insurance?

The procedure for acquiring a DIY insurance policy involves several key steps, empowering individuals to customize their coverage according to their unique needs and preferences:

1- Assess Your Needs

Begin by evaluating your financial situation and determining the coverage amount required. Consider factors such as existing financial obligations, future expenses, and the needs of your beneficiaries.

2- Research and Understand Options

Explore different types of life insurance policies available for DIY, such as whole life, term life, or universal life insurance. Understand their features, benefits, and potential drawbacks to choose the most suitable option.

3- Select Policy Components

Decide on the components of your Do-it-yourself life insurance policy, including the coverage amount, duration (for term policies), and any additional features, such as a cash value accumulation component.

4- Choose Investment Options

For policies involving a cash value component, select investment options that align with your risk tolerance and financial goals. These investments can influence the growth of the cash value portion of your policy.

5- Set Up the Policy

Apply for the DIY whole life insurance policy through a reputable provider or platform offering self-directed insurance options. Complete the necessary paperwork, disclose relevant information truthfully, and pay the premiums as agreed.

6- Manage and Review Regularly

Once the policy is established, regularly review it to ensure it aligns with your evolving needs. Consider adjusting coverage, premiums, or investment allocations if necessary.

7- Consider Trust Setup (Optional)

If desired, establish a trust to manage how the insurance proceeds will be distributed among beneficiaries after your passing. A trust offers control and can facilitate smoother estate planning.

By following these steps, individuals can effectively navigate the process of setting up a DIY insurance policy, tailoring it to their financial goals and ensuring comprehensive coverage while maintaining flexibility and control over their financial future.

DIY Whole Life Insurance for Seniors

DIY insurance presents a promising avenue for seniors seeking financial security tailored to their specific needs. As individuals age, traditional life insurance options might become limited due to factors such as health conditions and higher premiums. In this context, DIY insurance offers a viable alternative that empowers seniors to create customizable coverage without stringent medical underwriting.

One of the significant advantages of DIY insurance for seniors is its flexibility. It allows them to design a policy that suits their financial circumstances and future goals. Seniors can adjust coverage amounts, select suitable investment options, and potentially accumulate cash value over time, providing a financial cushion for themselves and their beneficiaries.

Moreover, DIY life insurance policies for seniors may not solely focus on providing a death benefit. They can be structured to accumulate cash value that seniors can access during their lifetime, offering a potential source of supplemental income or a safety net for unforeseen expenses.

Seniors exploring DIY insurance should consider consulting financial advisors or insurance professionals specializing in this domain. These experts can offer guidance tailored to individual circumstances, ensuring that seniors make informed decisions to secure their financial future through DIY insurance.

What Is the Cost of DIY Life Insurance?

The cost of DIY life insurance can vary based on several factors including age, health, desired coverage amount, and chosen investment options. Here’s a table outlining cost scenarios for different age groups and coverage amounts:

| Age Group | Desired Coverage Amount | Monthly Premium (Sample Estimates) |

| 30-40 | $250,000 | $30 – $50 |

| 40-50 | $500,000 | $60 – $100 |

| 50-60 | $750,000 | $120 – $200 |

| 60-70 | $1,000,000 | $250 – $400 |

Please note, these figures are approximate estimates and can vary significantly based on individual circumstances, such as health status, lifestyle, and specific policy features. Premiums may increase with age and can be affected by factors like smoking habits, pre-existing medical conditions, or the inclusion of cash value components.

It’s essential to consult with insurance providers or use online calculators provided by DIY insurance platforms to get personalized quotes based on your unique situation. Comparing quotes from various providers can help in understanding the cost implications and choosing the most suitable DIY life insurance policy that aligns with your budget and coverage needs.

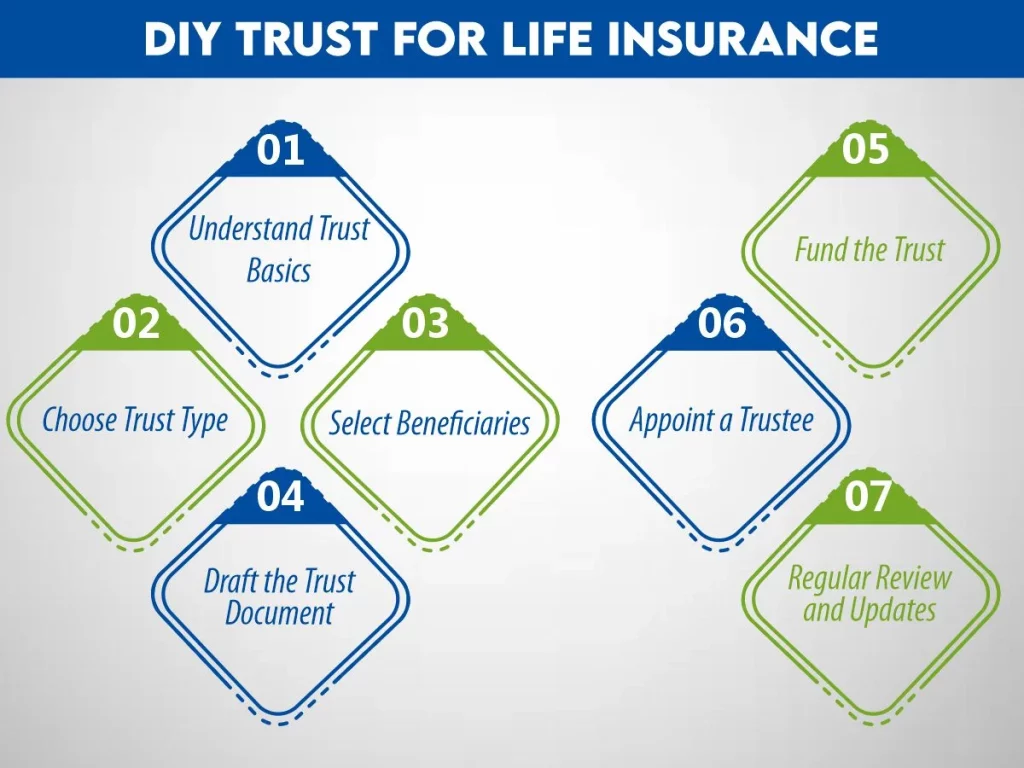

DIY Trust for Life Insurance

Establishing a trust in conjunction with a DIY insurance policy can be a prudent and strategic move for managing how the insurance proceeds are distributed among beneficiaries. A trust is a legal entity that allows you, as the policyholder, to designate how and when the funds from the life insurance policy will be disbursed.

Here’s an overview of the process of setting up a DIY trust for life insurance:

A trust is created by a legal document that specifies how assets, including life insurance proceeds, are managed and distributed. It appoints a trustee who administers the trust according to your instructions.

Decide on the type of trust that best fits your objectives. Common options include revocable trusts (can be altered during your lifetime) or irrevocable trusts (cannot be changed once established).

Determine who the beneficiaries of the trust will be and outline specific instructions on how and when they will receive the insurance proceeds. This allows you to control the distribution of funds even after your passing.

Work with a legal professional experienced in trust creation to draft the trust document. Ensure it aligns with your wishes and complies with applicable laws.

Once the trust is established, designate it as the beneficiary of your DIY life insurance policy. Upon your passing, the insurance proceeds will be paid directly into the trust.

Choose a trustee, whether an individual or a professional entity, to manage the trust and carry out your instructions as outlined in the trust document.

- Regular Review and Updates

Periodically review and update the trust as needed, especially when major life events occur or if there are changes in your financial or family circumstances.

A DIY trust for life insurance allows you to have greater control over how your assets, including the life insurance payout, are distributed and managed, ensuring that your intentions are carried out according to your wishes.

Conclusion

DIY life insurance offers a unique approach to securing financial protection tailored to individual needs. Its flexibility, potential for cash value accumulation, and customization options make it an attractive choice for those seeking personalized financial security. By understanding the procedures, costs, and benefits associated with DIY insurance, individuals can make informed decisions to safeguard their future and provide for their loved ones.