In the maze of life, preparing for the inevitable is an act of love. Enter Transamerica Burial Insurance; a beacon of reassurance in navigating life’s final chapter. When we talk about Transamerica, we’re delving into a realm where planning meets compassion, where the burden of end-of-life expenses finds solace.

Imagine your insurance plan as a safety net, tailored to ensure that your loved ones find comfort amidst the storm. In this detailed review, we’ll unravel the secrets behind Transamerica’s promise, exploring how it works, its perks, and yes, even its quirks. Get ready as we journey through this insurance landscape, illuminating your path towards understanding and securing the future; one policy at a time.

Transamerica Burial Insurance Review

Transamerica Burial Insurance is a type of life insurance designed specifically to cover end-of-life expenses such as funeral costs, medical bills, and outstanding debts that may burden your family after your passing. This insurance serves as a financial safety net, providing a lump-sum payout to your chosen beneficiaries upon your death.

The policyholder pays premiums to Transamerica in exchange for coverage, ensuring that loved ones are financially supported during a difficult time. One of the key features of Transamerica Burial Life Insurance is its simplicity, often requiring no medical exams and offering relatively quick approval processes. This coverage aims to ease the financial strain on families, allowing them to focus on honoring the life of the departed without worrying about overwhelming expenses.

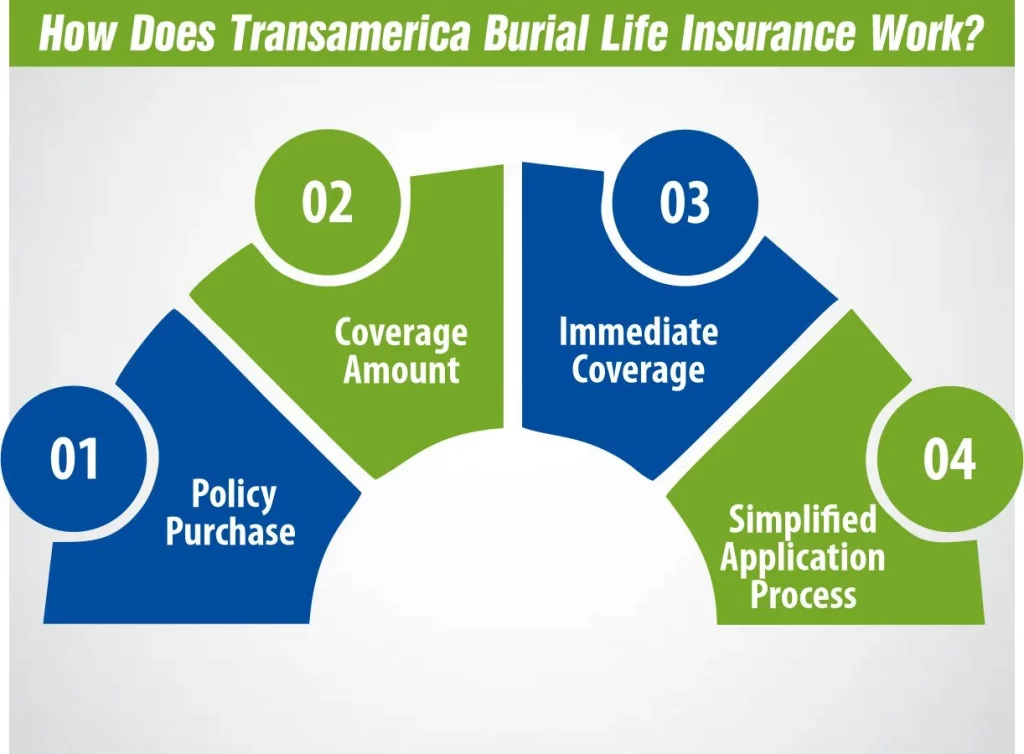

How Does Transamerica Burial Life Insurance Work?

Transamerica Burial Life Insurance operates similarly to traditional life insurance policies but is specifically tailored to cover end-of-life expenses. Here’s an overview of how it works:

1- Policy Purchase

Individuals interested in this insurance choose a policy based on their needs and budget. The policyholder pays regular premiums to Transamerica, either monthly or annually, to maintain coverage.

2- Coverage Amount

Upon the policyholder’s passing, Transamerica pays out a predetermined lump-sum benefit to the beneficiaries listed on the policy. This benefit can be used to cover funeral expenses, medical bills, outstanding debts, or any other expenses incurred after the policyholder’s death.

3- Immediate Coverage

One notable feature of Transamerica Burial Life Insurance is that it often offers immediate coverage without waiting periods. This means that beneficiaries typically receive the full death benefit from the start of the policy, unlike some other life insurance plans that may have waiting periods before providing full coverage.

4- Simplified Application Process

In many cases, Transamerica life burial insurance policies require minimal or no medical exams. Instead, applicants answer a few health-related questions during the application process, making it relatively easier and quicker to obtain coverage compared to more complex life insurance policies.

Pros and Cons of Transamerica Burial Insurance

Here are the pros and cons of Transamerica Life Burial Insurance:

Pros

- Immediate Coverage: Typically, Transamerica offers immediate coverage, ensuring beneficiaries receive the full death benefit from the start of the policy without waiting periods.

- Simplified Application: The application process often requires minimal or no medical exams, making it easier and quicker to obtain coverage compared to some other life insurance policies.

- Financial Security: It provides a lump-sum payout to beneficiaries, offering financial security to cover funeral expenses, medical bills, debts, and other end-of-life costs, relieving the financial burden on loved ones.

- Flexible Policy Options: Transamerica offers various policy options tailored to individual needs, providing flexibility in coverage amounts and premiums.

- Peace of Mind: Policyholders can have peace of mind, knowing their loved ones will have financial support during a difficult time, allowing them to focus on honoring their memory.

Cons

- Potentially Higher Premiums: Depending on age and health conditions, premiums for Transamerica Life Burial Insurance might be higher for certain individuals compared to other life insurance options.

- Coverage Limitations: There might be limitations on coverage amounts compared to some whole life insurance policies, which could affect the extent of financial support provided.

- Age Restrictions: Some policies may have age restrictions, making it more challenging or expensive to obtain coverage for older individuals.

- Limited Investment Potential: Unlike some other life insurance policies, burial insurance may have limited or no investment components, offering only a death benefit without potential cash value growth.

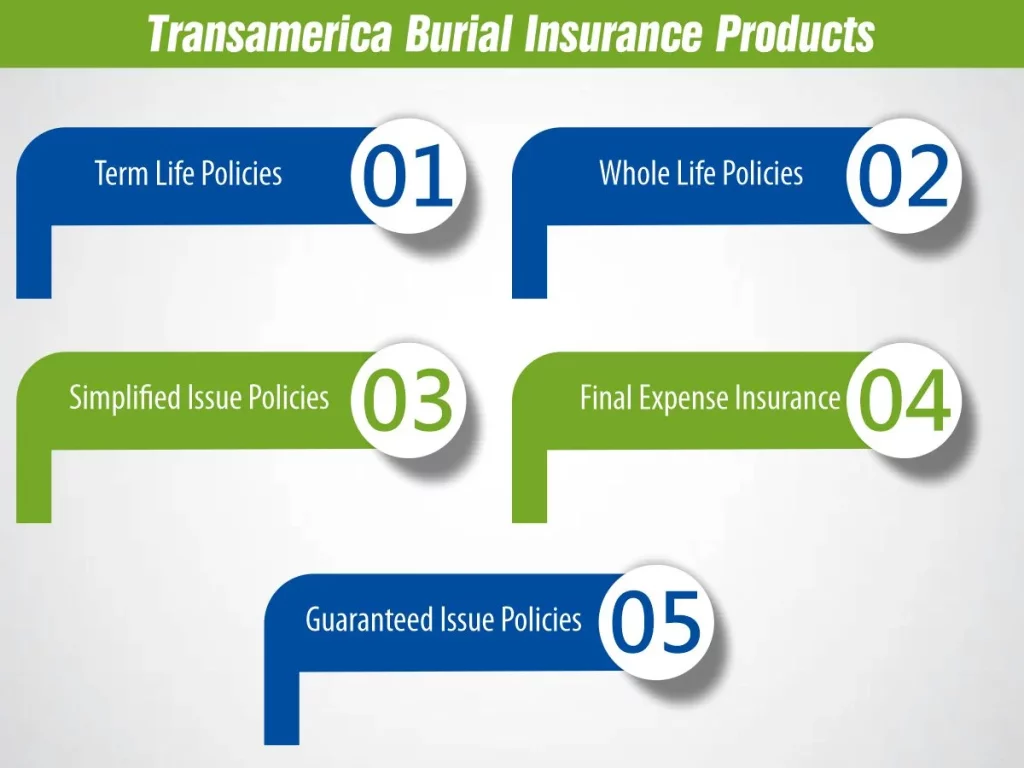

Transamerica Burial Insurance Products

Transamerica offers a range of burial insurance products tailored to meet various needs and preferences. These products aim to provide financial support for end-of-life expenses. Here are some of Transamerica’s burial insurance offerings:

1- Term Life Policies

These policies provide coverage for a specified term, offering a death benefit if the insured passes away during the term of the policy. Term life policies from Transamerica might be suitable for individuals seeking coverage for a specific period.

2- Whole Life Policies

Transamerica’s whole life insurance offers lifelong coverage with a guaranteed death benefit. These policies typically have fixed premiums and accumulate cash value over time, which can be borrowed against or withdrawn.

3- Simplified Issue Policies

These policies are designed for individuals who might have health issues or concerns. They often require minimal or no medical exams and involve answering a few health-related questions during the application process for approval.

4- Final Expense Insurance

This specialized insurance focuses on covering funeral and burial costs, outstanding debts, and other end-of-life expenses. It is crafted to alleviate the financial burden on families during a challenging time.

5- Guaranteed Issue Policies

These policies generally do not require a medical exam or health questions, making them available to almost anyone who applies within a specified age range. Guaranteed-issue policies may be an option for individuals with health conditions that might otherwise hinder obtaining traditional life insurance.

What is the cost of Transamerica Burial Insurance?

The cost of Transamerica burial insurance varies based on factors such as age, health, coverage amount, and chosen policy. Generally, premiums for burial insurance tend to be more affordable than larger life insurance policies, but costs can increase for older individuals or those with health issues.

Here’s a sample table outlining potential monthly premium ranges for Transamerica Life Burial Insurance:

| Age Range | Coverage Amount | Monthly Premium Range |

| 50 – 60 | $5,000 – $15,000 | $20 – $80 |

| 61 – 70 | $5,000 – $15,000 | $30 – $100 |

| 71 – 80 | $5,000 – $15,000 | $40 – $150 |

| 81 – 85 | $5,000 – $15,000 | $60 – $200 |

Please note that these figures are approximate and can vary significantly based on several factors including the applicant’s health, location, chosen coverage amount, and specific policy details.

Moreover, while considering Transamerica Life Burial Insurance costs, it’s essential to assess your budget, the level of coverage needed, and your ability to pay premiums over the long term. Comparing quotes and policy features can help determine the most suitable and affordable coverage for your situation.

Does Transamerica Offer First-Day Coverage?

Transamerica’s burial insurance typically offers immediate coverage, meaning beneficiaries receive the full death benefit from the outset. This eliminates waiting periods often associated with other life insurance policies.

Comparison between Transamerica and M Life insurance

When comparing Transamerica Life Burial Insurance with M Life Insurance, it’s crucial to examine several aspects to make an informed decision based on individual needs. Here’s a comparative overview:

Transamerica Burial Insurance

Transamerica offers a variety of burial insurance products, including term life, whole life, and simplified issue policies. These options cater to different preferences and health conditions, providing flexibility in coverage choices.

Typically, Transamerica’s burial insurance involves a simplified application, often requiring minimal or no medical exams. This streamlined process may make it easier and quicker to obtain coverage.

Transamerica often provides immediate coverage without waiting periods for the full death benefit, ensuring beneficiaries receive the payout from the start of the policy.

Premiums for Transamerica burial insurance vary based on factors such as age, health, and coverage amount. The company aims to offer competitive rates while providing comprehensive coverage for end-of-life expenses.

M Life Insurance

M Life Insurance may offer a range of life insurance products, including term, whole life, and universal life policies, with varying features and benefits.

M Life Insurance might have different underwriting requirements, possibly involving more detailed medical evaluations or health assessments during the application process.

The coverage terms and conditions, such as waiting periods or immediate coverage, may differ from those offered by Transamerica. Some policies may have waiting periods before full benefits are accessible.

Premiums for M Life Insurance policies are influenced by individual factors like age, health, and coverage amount. Comparative analysis can help assess whether their rates align with your budget and coverage needs.

Choosing Between Transamerica and M Life Insurance

Deciding between Transamerica and M Life Insurance involves considering various factors such as policy options, application processes, coverage terms, and premium affordability. It’s crucial to:

- Compare specific policy details, including coverage amounts, terms, and any restrictions.

- Evaluate premiums and ensure they fit within your budget.

- Consider the ease of application and underwriting processes.

- Assess the immediate coverage and waiting periods, if any, for each company’s policies.

Ultimately, selecting the right burial insurance provider, be it Transamerica or M Life Insurance, depends on individual preferences, health considerations, and financial circumstances. Reviewing policy specifics and consulting with representatives from both companies can help in making an informed decision that best suits your needs.